st louis county sales tax calculator

Saint Louis has parts of it located within St. 2020 rates included for use while preparing your income tax deduction.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Saint Louis County in Missouri has a tax rate of 761 for 2022 this includes the Missouri Sales Tax Rate of 423 and Local Sales Tax Rates in Saint Louis County totaling 338.

. Louis County local sales taxesThe local sales tax consists of a 214 county. This is the total of state and county sales tax rates. The Missouri statewide rate is 4225 which by itself would be.

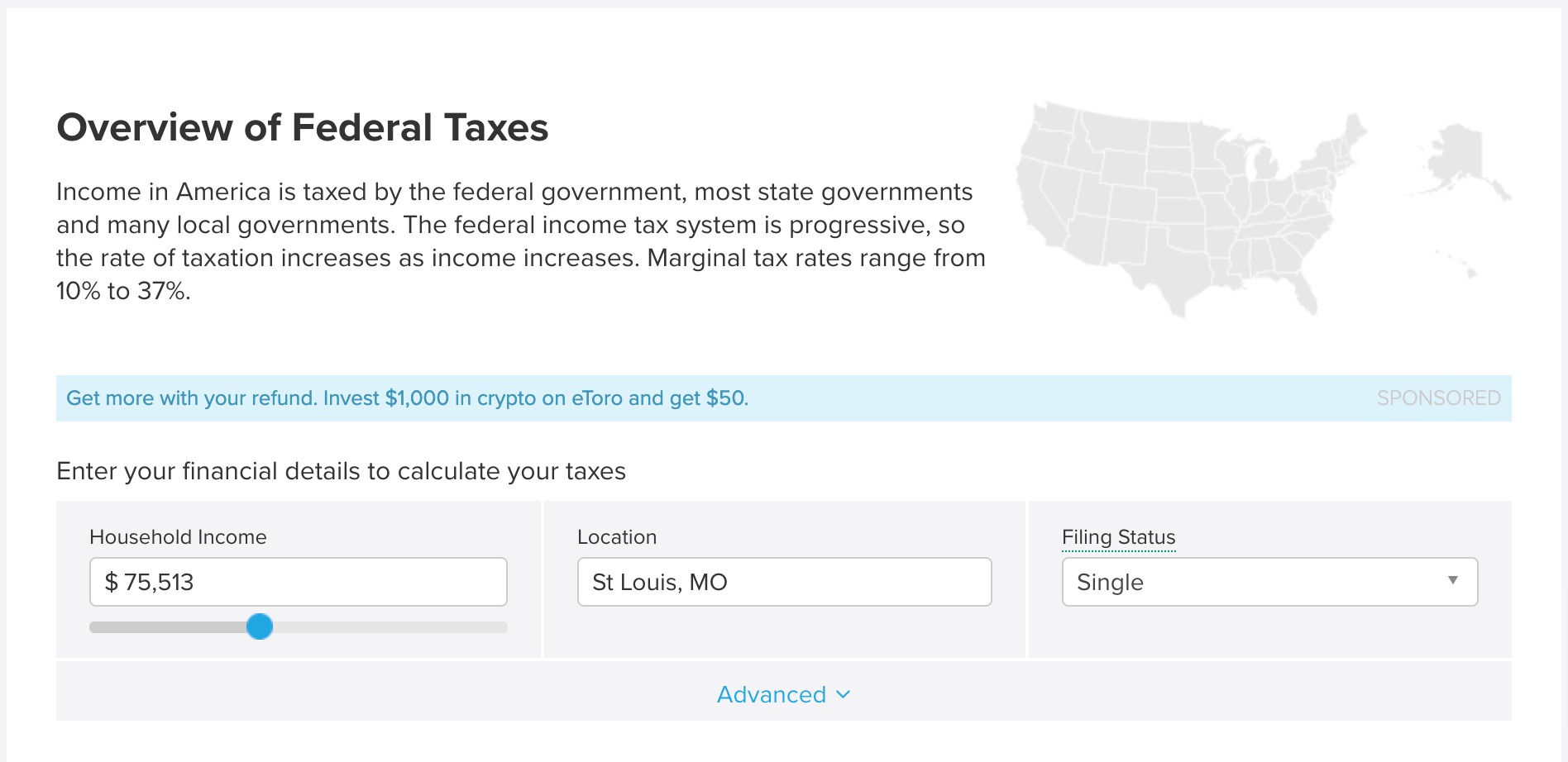

2020 rates included for use while preparing your income tax deduction. Subtract these values if any from the sale price of the unit and enter the net price in the calculator. The minimum combined 2022 sales tax rate for St Louis County Missouri is.

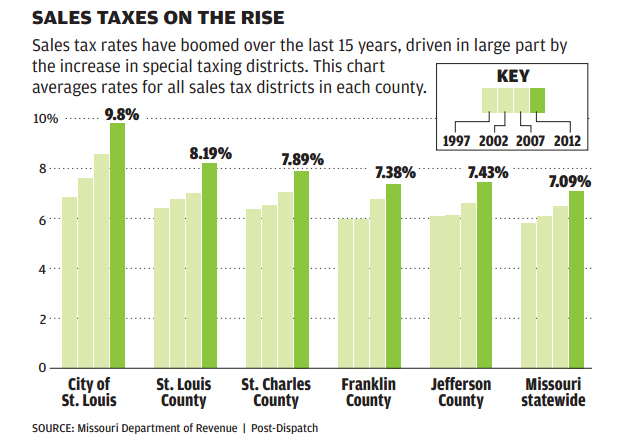

Sales taxes are another important source of revenue for state and local governments in Missouri. Sales Tax Table For St. Saint Louis County in Minnesota has a tax rate of 738 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in Saint Louis County totaling 05.

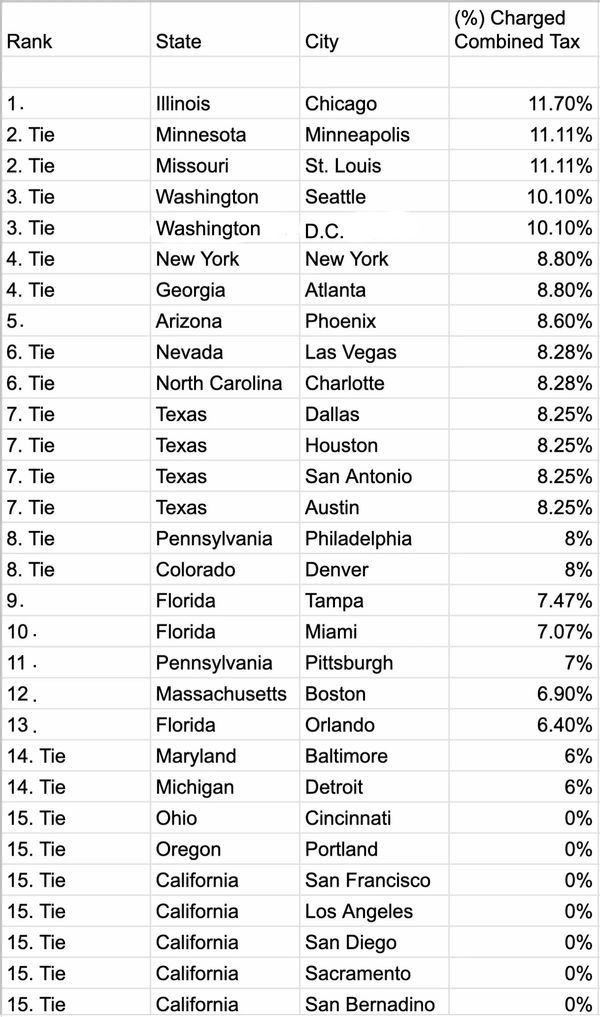

Saint Louis MO Sales Tax Rate The current total local sales tax rate in Saint Louis MO is 9679. The average cumulative sales tax rate in Saint Louis Missouri is 921. Hazelwood MO 11988 sales tax in St Louis County 20945 for a 20000 purchase Roscoe MO 4725 sales tax in St Clair County You can use our Missouri sales tax calculator to.

This rate includes any state county city and local sales taxes. Sales tax in Saint Louis County Missouri is currently 761. Missouri has a 4225 sales tax and St Louis County collects an additional 2263 so the minimum sales tax rate in St Louis County is 6488 not including any city or special district.

The sales tax rate for Saint Louis County was updated for the 2020 tax year this is the current sales tax rate we are using in the. You pay tax on the sale price of the unit less any trade-in or rebate. This rate includes any state county city and local sales taxes.

Louis County local sales taxesThe local sales tax consists of a 050 special. Bond Refund or Release Request. Louis County Minnesota Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 773 in St.

What is the sales tax rate in St Louis County. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St. The latest sales tax rate for Saint Louis County MO.

The December 2020 total local sales tax rate was also 9679. This includes the rates on the state county city and special levels. The latest sales tax rate for Saint Louis MO.

Additions to Tax and Interest Calculator. Louis County Minnesota sales tax is 738 consisting of 688 Minnesota state sales tax and 050 St. Their website states You must pay the state sales tax AND any local taxes of the city or county where you live not where you purchased the vehicleThe state sales tax rate is 4225 percent.

To calculate the sales tax amount for all other values. The latest sales tax rate for Saint Louis County MN. Motor Vehicle Trailer ATV and Watercraft Tax Calculator.

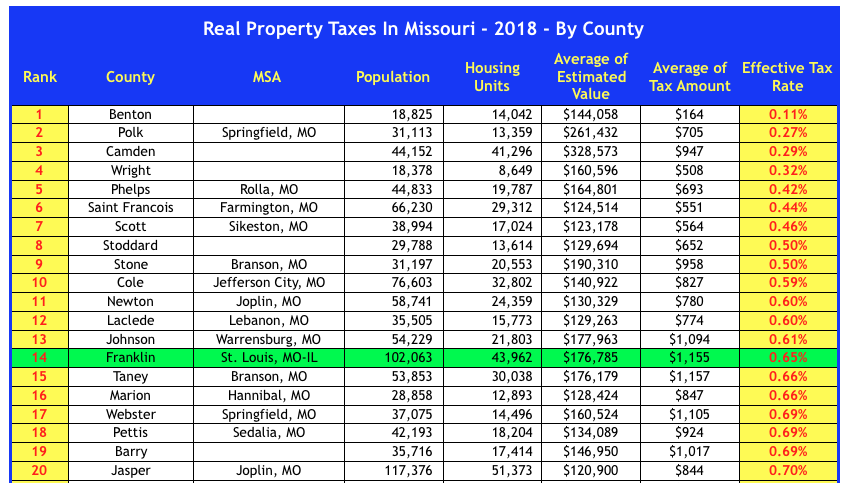

The median property tax on a 17930000 house is 163163 in Missouri.

Minnesota Property Tax Calculator Smartasset

Kansas Department Of Revenue Pub Ks 1510 Sales Tax And Compensating Use Tax

Missouri Sales Tax Calculator And Economy 2022 Investomatica

Las Vegas Sales Tax Rate And Calculator 2021 Wise

Property Tax By County Property Tax Calculator Rethority

Missouri Sales Tax Rate Rates Calculator Avalara

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

County Assessor St Louis County Website

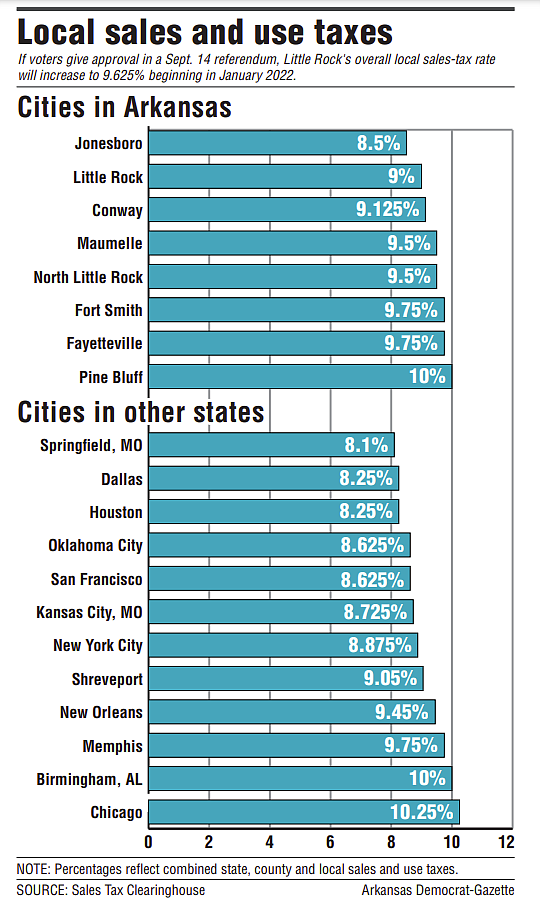

As Tax Rates Go Arkansas At Top

Local Income Taxes In 2019 Local Income Tax City County Level

Cook County Increases Its Sales Tax By One Percentage Point The Civic Federation

Missouri Property Tax Calculator Smartasset

Missouri Car Sales Tax Calculator

The 20 Best Online Tools To Calculate Your Income Taxes In 2021

St Louis County Has The Highest Tax Rates In The State St Louis Real Estate News

Sales Taxes In St Louis Relentlessly On The Rise Local Business Stltoday Com

Coffee And Community Improvement Districts Unpacking The Mystery Of The 7 Starbucks Macchiato Salon Com

The Non Profit Paradox 40 Of Real Estate In St Louis Is Government Owned Or Tax Exempt Nextstl